Author: Dev Patel | EQMint

Company History

5ire (pronounced “five-ire”) was founded in August 2021 with the bold vision of creating a sustainability-driven, user-centric blockchain ecosystem aligned with the United Nations’ Sustainable Development Goals (SDGs). The founders believed that the emerging Web3 / blockchain paradigm could be reimagined not merely for profit, but for “for-benefit” — integrating environmental, social, and governance goals into the core of blockchain infrastructure.

Within 11 months of its founding, 5ire raised a US$100 million Series A funding round led by the UK conglomerate SRAM & MRAM, valuing the company at US$1.5 billion — thus catapulting it to unicorn status. This rapid ascendancy made 5ire one of the fastest blockchain startups in India to reach unicorn valuation.

Since then, 5ire has expanded its ecosystem to include a blockchain network (Layer-1) called 5ireChain, along with supporting components such as a wallet, crypto exchange, NFT marketplace, VC arm (5ire VC), and R&D hub (5ire Labs). The startup also inked MOUs and partnerships in India, Nigeria, and the U.S. to pilot blockchain solutions for governance, sustainability, and digital identity.

However, the journey has not been without turbulence. A 2024 exposé raised doubts about certain funding disclosures and delays, with insiders claiming that some announced fund transfers never materialized. The controversies point to challenges in execution, transparency, and investor relations, which are particularly critical in the highly scrutinized blockchain domain.

As of September 2025, 5ire is listed in databases such as Tracxn as a Series A-stage firm based in Dubai, with total funding of ~$121 million and a valuation pegged at ~$1.5B. Top competitors include blockchain infrastructure players like NEAR, Aptos, and Mysten Labs.

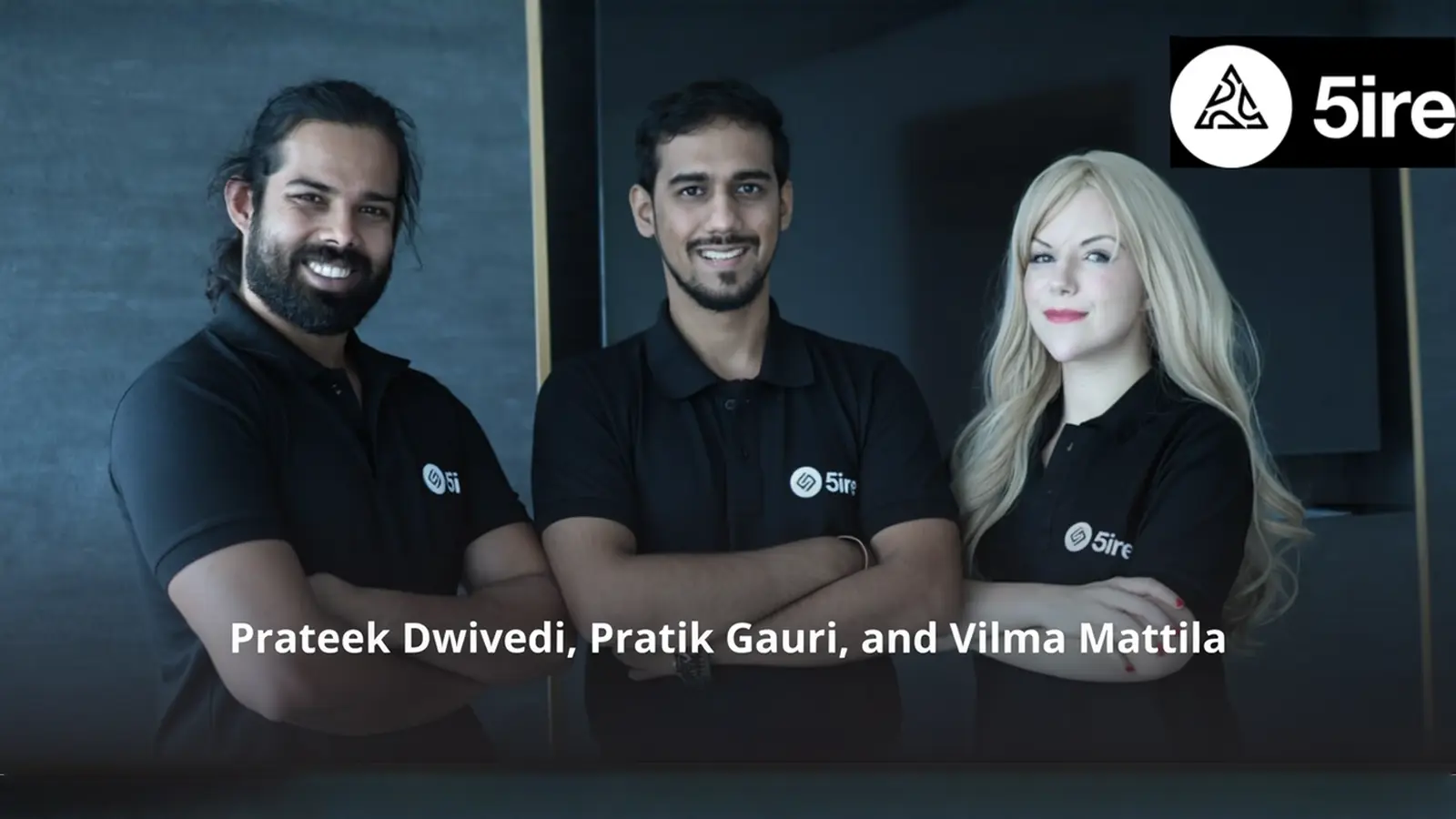

Founders

-

- Pratik Gauri — Co-founder & CEO. Gauri provides the strategic vision of embedding sustainability into blockchain and has pushed the narrative from “profit” to “benefit.”

-

- Prateek Dwivedi — Co-founder. He contributes expertise in growth, operations, and crypto strategy.

-

- Vilma Mattila — Co-founder / Web3 financier. Mattila, from Finland, brings international crypto and blockchain domain experience.

These three created 5ire drawing on global blockchain networks. The team has since grown to include engineering, research, tokenomics, legal, and business development professionals.

Business Model

5ire’s business model is multi-faceted, combining blockchain infrastructure, token economics, ecosystem services, and venture investing. The key components are:

Layer-1 Blockchain (5ireChain)

-

- A native blockchain network designed to support transactions, smart contracts, decentralized applications (dApps), and governance with sustainability metrics built in.

-

- It introduces a consensus / validation paradigm called “proof of benefit”, wherein nodes or participants may be aligned to sustainable or ESG goals.

-

- The chain’s architecture is intended to be scalable, upgradeable, and future-proof to support the ambitions of 5IR (5th Industrial Revolution).

Ecosystem Services

-

- Wallets & Exchange: 5ire plans or operates its own wallet and exchange, facilitating on-chain operations and liquidity.

-

- NFT Marketplace: Supporting NFTs built on 5ireChain, enabling digital assets, art, identity, and tokenized assets.

-

- 5ire VC & Labs: As part of its vision, 5ire invests in early projects aligned with sustainability / ESG goals and supports deep R&D.

-

- Governance & DAO Tools: Offering infrastructure for decentralized autonomous organizations (DAOs), voting, and governance primitives integrated with ESG metrics.

Token & Economic Model

-

- Native tokens / utility tokens are expected to fuel the network, rewarding validators, stakeholders, and participants.

-

- Transaction fees, governance fees, or staking rewards can be monetization levers.

-

- The model emphasizes sustainability—rewarding nodes / behavior aligned with climate / social goals.

Strategic Partnerships & Use-Cases

-

- 5ire signs partnerships with governments, institutions, and corporates in India, Nigeria, and the U.S. to pilot blockchain use in identity, public services, carbon credits, law enforcement, etc.

-

- A noted example: collaboration with AICTE in India to launch YourOneLife (YOL) — a blockchain-based “happiness index / academic credentials & well-being” application.

Network Effects & Ecosystem Growth

-

- As more projects, dApps, and users join 5ireChain, the value of the network rises. Higher usage feeds transaction volume, token demand, and ecosystem services.

-

- Through 5ire VC and Labs, 5ire can incubate projects that anchor to its chain, locking in growth and interdependence.

In sum, 5ire functions as both a blockchain protocol and an ecosystem operator, combining infrastructure, tokenomics, venture build, and sustainability narrative in one package.

Current Competitors

In the blockchain / Web3 infrastructure space, 5ire competes with established and emerging Layer-1 or Layer-2 protocols, particularly those that emphasize scalability, governance, or ESG alignment. Some key competitors include:

-

- NEAR Protocol — A performant, developer-friendly Layer-1 blockchain focusing on scalability and usability. (Listed by Tracxn as a top peer)

-

- Aptos — A U.S.-based high-performance blockchain with developer tooling and ambitions to power Web3 applications.

-

- Mysten Labs / Sui — Another blockchain infrastructure startup focusing on performance, security, and developer experience.

-

- Ethereum / Solana / Polkadot / Avalanche — More mature ecosystems with strong adoption, developer base, and liquidity (though different design trade-offs).

-

- Cosmos / Tendermint / Substrate-based chains — Ecosystem players enabling interoperability and modular blockchains.

-

- ESG-oriented crypto / environmental chains — Emerging protocols trying to blend crypto with environmental or carbon credit features (though few have full maturity).

-

- Other sustainable / ESG blockchain projects — Startups that build on carbon markets, climate data, or governance overlays compete in adjacent use-case niches.

Because 5ire positions itself uniquely with a sustainability + benefit orientation, its competitive edges or vulnerability will depend not just on performance, but credibility, adoption, ecosystem execution, and transparency.

Challenges & Risks

While 5ire’s vision is bold and novel, it faces significant risks:

Fundraising & Transparency

-

- Reports in 2024 alleged that certain funding rounds were misrepresented or never materialized, undermining investor trust.

-

- The crypto / Web3 space is under heightened regulatory scrutiny; discrepancies in tokenomics or funding raise red flags.

Execution Complexity

-

- Building a full Layer-1 chain, wallets, exchange, NFT marketplace, DAO tooling, VC arm, and governance stack is highly complex and resource intensive.

-

- Each component must function well individually and integrate smoothly.

Adoption & Ecosystem Bootstrapping

-

- Attracting developers, users, dApps, and liquidity is a classic “chicken-and-egg” problem.

-

- Persuading projects to build on 5ire vs. more established chains requires compelling advantages (performance, cost, ESG alignment).

Sustainability / ESG Validity

-

- The promise of aligning blockchain operations with sustainable goals must withstand scrutiny. If metrics are superficial or misaligned, it could be seen as “greenwashing.”

-

- Verifying real-world ESG impact is difficult and may invite skepticism or audits.

Token Volatility & Economic Risk

-

- Token valuation swings, security exploits, or governance failures can damage confidence and utility.

-

- Dependence on token economics to support infrastructure and reward participants is inherently risky.

Regulation & Legal Risk

-

- Crypto / blockchain regulation is evolving globally. 5ire must navigate compliance, securities laws, taxation, cross-border rules, and KYC/AML obligations.

-

- Partnerships with government bodies require high trust and legal clarity.

Reputational & Credibility Risk

-

- In light of the accusations in 2024, maintaining credibility and ensuring proper disclosures will be essential.

-

- Any misstep in execution or transparency could affect user, investor, and partner confidence.

Future Outlook & Strategic Focus

To succeed, 5ire needs to steer carefully between visionary ambition and pragmatic execution. Some strategic priorities:

-

- Strengthen transparency & audits — publishing proof of funds, third-party audits, and clear tokenomics to regain or maintain trust.

-

- Focus on flagship use-cases / pilots — delivering real-world projects (e.g. public services, identity, sustainability) to demonstrate impact and differentiate from generic chains.

-

- Developer & community incentives — grants, hackathons, developer tooling, SDKs, and support to attract ecosystem participation.

-

- Partnership expansion — deeper engagements with governments, institutions, corporates to anchor pilot projects and adoption.

-

- Iterative product launches — rolling out components (wallet, exchange, marketplace) in stages to de-risk build.

-

- Token utility & reward design — ensure token model aligns incentives, governance, sustainability without over-leveraging.

-

- Global expansion with local anchoring — scaling beyond India to Africa, Latin America, etc., while anchoring in regions with regulatory openness.

If executed well, 5ire could become a standout example of how blockchain can commit to ESG goals while enabling decentralized infrastructure — but the margin for error is narrow.

References

- Blockchain startup 5ire turns unicorn after raising $100M — Inc42

- India’s Latest Blockchain Unicorn 5ire Valued at $1.5B — Blockworks

- Moneycontrol: 5ire becomes India’s 105th unicorn

- Tracxn company profile for 5ire

Disclaimer: This article is based on information available from public sources. It has not been reported by EQMint journalists. EQMint has compiled and presented the content for informational purposes only and does not guarantee its accuracy or completeness. Readers are advised to verify details independently before relying on them.