Fed Meeting in Focus

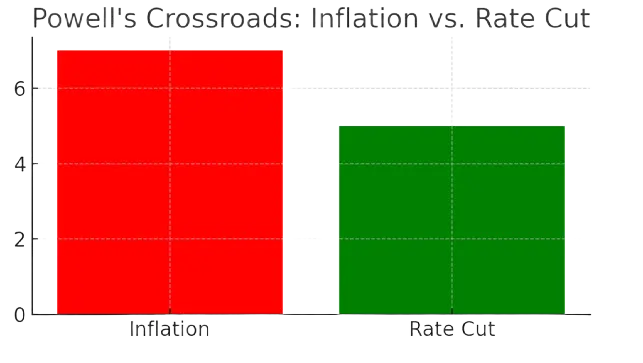

Inflation dominates the September 2025 meeting of the Federal Open Market Committee (FOMC), drawing the attention of global investors, policymakers, and financial markets. Inflation stands at the heart of Jerome Powell’s toughest balancing act as he weighs policy options. Inflation is one concern, while markets are simultaneously pricing in a 25 basis point rate cut — the Fed’s first reduction of the year. Inflation remains above the Fed’s 2% target, complicating any move to loosen monetary policy. Inflation pressures arrive just as job growth cools, consumer confidence weakens, and political interference reaches its highest level in years.

Political Pressure on Powell

Monetary policy decisions are rarely made in a vacuum, and Powell is facing particularly acute political heat. President Donald Trump has made repeated public calls for deeper and faster rate cuts, framing them as essential for sustaining growth and strengthening U.S. competitiveness.

Adding to the pressure, Stephen Miran, a Trump-backed economist, was recently sworn in as a Fed governor. His appointment, along with earlier Trump allies in key positions, has raised concerns that the administration is exerting undue influence over the central bank. For decades, the Fed has prided itself on independence from short-term political agendas. Critics now warn that this tradition is under threat, with potential consequences for credibility and investor trust.

Economic Data Confusion

The economic signals complicating Powell’s decision are mixed at best:

-

- Inflation – The core Personal Consumption Expenditures (PCE) index, the Fed’s preferred inflation gauge, continues to run above the 2% target, suggesting price stability remains elusive.

-

- Labor market – While unemployment remains relatively low, payroll growth has slowed, and job openings are declining. This points to an economy losing some momentum.

-

- Consumer and business sentiment – Surveys show households becoming more cautious with spending, while businesses are delaying investment amid uncertainty over rates and trade policy.

This combination of persistent inflation and weakening growth is a classic policy dilemma. Move too aggressively, and inflation may spiral again. Move too cautiously, and recessionary pressures could intensify.

Risks if Powell Missteps

The Fed’s next steps carry risks that extend beyond short-term market moves:

-

- Aggressive rate cuts could reignite inflation, undermining the Fed’s credibility as an inflation-fighter and destabilizing expectations.

-

- Cautious or delayed action could deepen the economic slowdown, leading to higher unemployment and tighter financial conditions.

-

- Political interference risks damaging the perception of U.S. monetary policy independence, which has long been a cornerstone of global confidence in the dollar and U.S. markets.

Markets are not just focused on the September decision but on Powell’s language around the pace and scope of future cuts. His tone could either reassure investors or spark volatility.

Opinion: Powell’s Tightrope Walk

In our view, Powell will most likely opt for a measured 25 basis point cut. This move strikes a middle ground: it acknowledges slowing economic momentum without abandoning the fight against inflation. Yet the more important element will be Powell’s forward guidance.

If Powell signals that the Fed remains flexible — open to more cuts if growth weakens further — while also reaffirming a firm commitment to bringing inflation under control, he could succeed in calming both markets and policymakers. This dual message may buy the Fed time to reassess incoming data without locking into an overly dovish or hawkish stance.

Still, Powell’s task is complicated by Trump’s very public demands for sharper cuts. Every word will be scrutinized, not just for its economic content but for what it reveals about the Fed’s ability to act independently under political pressure.

The Road Ahead

The September meeting will not resolve the Fed’s challenges, but it will set the tone for the remainder of 2025. Investors will be watching for clarity on whether the Fed intends to embark on a series of gradual cuts or stick to a one-off adjustment.

Much depends on the balance Powell strikes: between supporting growth and safeguarding credibility, between responding to political calls and protecting institutional independence. In many ways, Powell’s leadership in this moment will shape not only U.S. monetary policy but also global financial stability.

For now, markets wait — and Powell walks the tightrope.

References

Disclaimer: This article is for informational purposes only. The views expressed are those of the author and do not necessarily represent the views of EqMint. EqMint assumes no liability for the information presented here.