Author : Aashiya Jain | EQMint | Entertainment

For decades, investing in a big‑budget Bollywood film was a simple but nerve‑racking proposition: you backed the movie, and you crossed your fingers. There were only two outcomes a hit that filled theatres and turned profits, or a flop that left financiers nursing losses. That binary reality, familiar to producers and investors alike, is now giving way to a more sophisticated, engineered approach to film financing.

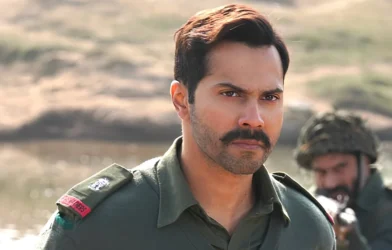

A compelling example of this shift is Dhurandhar, the 2025 spy‑action thriller starring Ranveer Singh. The movie now part of a two‑part release strategy shows how producers are front‑loading revenue streams and structuring projects so that a large portion of capital is reclaimed well before the theatrical run has concluded.

Dhurandhar’s Ambitious Scale and Two‑Part Strategy

Dhurandhar began as a single screenplay, but as the story expanded and the footage grew longer, the makers chose to split it into two parts rather than cut content. This decision came during post‑production, when director Aditya Dhar and his team realized that the narrative’s breadth and emotional arcs demanded a broader canvas than a single film could accommodate.

The result is a movie experience that feels almost epic in scope. Part 1 alone runs over 214 minutes one of the longest mainstream Hindi films released in years and includes a post‑credits scene teasing Part 2, now scheduled for theatrical release on 19 March 2026.

By splitting the story like this, the producers didn’t just serve cinematic logic they also unlocked a new financial framework. Instead of relying solely on box‑office receipts to pay back investors, Dhurandhar’s makers have structured monetisation so that substantial sums are booked early in the financing cycle.

Front‑Loaded Monetisation: Breaking Down the Money Flows

Under this emerging model, producers aim to secure revenue from multiple pre‑release channels. For Dhurandhar, these include:

- Theatrical Revenue: Strong advance bookings and sustained box‑office performance help recover costs quickly. The first instalment crossed the ₹200 crore mark domestically early in its run and has since joined the elite ₹1,000 crore worldwide club a rare milestone that places it among the most commercially successful Indian films of the year.

- Streaming Rights: In a time when OTT platforms are key players in film financing, Dhurandhar struck a noteworthy deal with Netflix reportedly worth ₹130 crore for both parts combined. That means roughly ₹65 crore per film is already locked in, independent of theatrical performance.

- Pre‑Sales and Ancillary Guarantees: While box‑office earnings are front and centre, pre‑sold rights sometimes include overseas distribution and regional licensing that further reduce the risk on theatrical recovery.

Putting all this together, industry estimates suggest that the combined production budget for both parts sits in the ₹250–₹280 crore range a figure often split between local production costs, marketing, and post‑production workflows.

Risk, Reward, and a Changing Financial Blueprint

At its core, this strategy transforms financing from a hit‑or‑miss gamble into a more measured financial exercise. Securing OTT rights and pre‑release deals means producers begin reclaiming investments early, often before word‑of‑mouth and box‑office trends have fully unfolded. From a cash‑flow perspective, that changes the game.

For Dhurandhar, this front‑loaded structure likely means that the first instalment has already covered a large portion of its production and marketing costs, while the profits from Part 2 and ongoing box‑office receipts will flow more directly to the bottom line.

This kind of planning isn’t just about risk mitigation. It also gives filmmakers the freedom to focus on storytelling without the panic that a single weekend’s collections will make or break the entire enterprise. When revenue is diversified across multiple channels, creative choices can lean more toward spectacle and narrative depth rather than purely commercial safe bets.

Why This Matters Beyond One Film

The success of Dhurandhar both as a story and as a financial model reflects a broader shift in Bollywood’s ecosystem. With the rise of streaming platforms, expanded global markets, and increasingly sophisticated financing structures, producers are no longer bound to the old binary of hit or flop.

No longer is box‑office the only place where money is made or lost. Instead, filmmakers and financiers are turning projects into multi‑layered revenue ecosystems. Studios index success not just by ticket sales, but by how quickly and reliably they can recoup investment through strategic monetisation.

For audiences, this often means better‑funded productions and more ambitious cinematic worlds. For investors, it means clearer paths to returns and the ability to weather fluctuations in theatrical attendance.

For more such a information : EQMint

Resource Link : EQMint