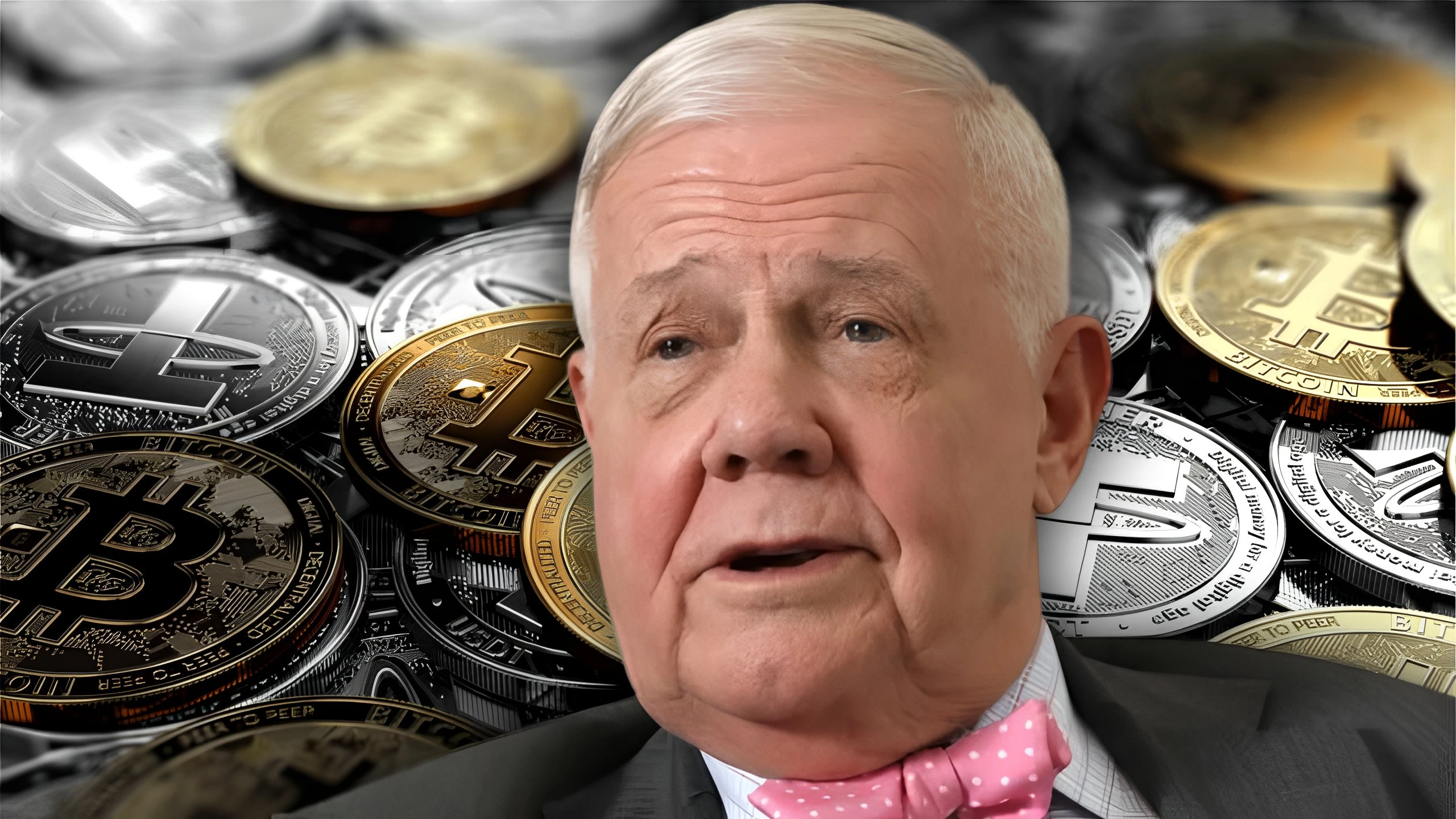

Legendary investor Jim Rogers shared a powerful observation about market cycles that resonates strongly with long-term investors: “Bottoms in the investment world don’t end with four-year lows. They end with 10- or 15-year lows.” Speaking in the context of recent volatility across global equity markets, Rogers’ quote underscores the importance of patience, perspective, and understanding the deeper rhythms of financial markets. His insight serves as a reminder that true market bottoms and the best opportunities often emerge only after prolonged periods of pain and pessimism.

Author: Aashiya Jain | EQMint | Market News

Rogers’ Perspective: Looking Beyond Short-Term Noise

Jim Rogers, co-founder of the Quantum Fund and a longstanding figure in global investing, has long been known for his macroeconomic insight and contrarian approach. In the latest “Market Quote of the Day,” he distilled a profound truth about financial markets into a single line:

“Bottoms in the investment world don’t end with four-year lows. They end with 10- or 15-year lows.”

This observation points to something investors often struggle with. Short-term lows are not true bottoms. While indices and stocks make cyclical declines every few years, these pullbacks usually happen within longer uptrends.

What Rogers calls a bottom is way deeper. It’s a level reached only after extended pessimism or big economic shifts. Historically true bottoms have often come with widespread fear and scepticism. Like the 2008-09 financial crisis or the early 2000s tech crash. Both followed long downturns and washed out weak hands before sentiment improved. These were not four-year corrections. They were deep multi-year resets in valuation and confidence. That’s the context Rogers wants investors thinking in. Not quarterly moves or typical business cycles. But generational inflection points.

Why the Quote Matters in Today’s Markets

Global markets have seen heightened volatility in recent months. Investors have contended with mixed economic data, geopolitical tensions, inflation concerns, and uncertainty over interest rate paths from major central banks. Such noise can be distracting and emotionally charged. Yet, what Rogers’ quote reminds us is that not every downturn is a long term buying opportunity unless it evolves into a deeper structural shift.

For everyday investors, understanding this distinction is crucial. Many headlines proclaim “markets in correction” or “stocks at four-year lows,” which can trigger knee-jerk reactions. But a true long-term bottom one that presents generational opportunity usually appears when economic fundamentals are deeply challenged and sentiment is bleak across the board.

That’s when companies and assets may become significantly undervalued relative to their long-term prospects.

A Lesson in Patience and Perspective

One of the key takeaways from Rogers’ insight is the value of patience. Investing is not a sprint; it’s a marathon that rewards those who can view price action over decades, not days. Short-term fluctuations matter for traders, but long-term investors build wealth by riding broader secular trends.

In a world where financial media often focuses on daily price changes, this quote serves as a healthy corrective. Instead of obsessing over short-term lows and minor corrections, investors can benefit from:

- Understanding long-term economic cycles

- Avoiding emotional trading decisions

- Allocating capital with a multi-year horizon

- Focusing on fundamentals over noise

Generational wealth is rarely created by timing the exact bottom. Rather, it comes from recognising structural shifts early and staying invested through cycles of fear and uncertainty.

How This Applies to Indian Investors

For Indian investors this lesson is especially relevant Indian markets have seen several cycles of volatility from global crises to domestic economic reforms yet long term returns have tended to reflect the underlying growth story of the economy.

Investors who stayed focused on fundamentals diversified their portfolios and avoided reacting to every headline have historically benefited Rogers perspective can encourage Indian market participants to broaden their time horizon and view short-term corrections as part of a larger cycle rather than definitive signals of a collapsed market.

This is important because India’s market has always had ups and downs and the ones who didn’t panic usually came out ahead Short-term drops don’t always mean the end of the story they’re often just part of the process. The key is to stay focused on the bigger picture and not get caught up in every little change Indian investors who have done this in the past have usually seen good results over time It’s about patience and perspective more than anything else.

A Final Thought

Jim Rogers’ observation is more than a catchy quote it’s a philosophical guidepost. In essence, he’s reminding investors that real opportunity often emerges only after prolonged periods of difficulty, and that true bottoms are defined by confidence lost and regained over long stretches, not brief pullbacks.

As markets continue to navigate uncertainty, this kind of perspective can help investors stay grounded, avoid common emotional traps, and build a resilient approach that aligns with the realities of how financial markets truly evolve over time.

For more such information visit EQMint

Source link : ET

Disclaimer: This article is not an investment advice and is for educational purpose only