The government’s recent GST reform is being celebrated as a game-changing initiative aimed at making life more affordable while accelerating economic growth. By reducing tax rates on essential goods and services, this reform is helping families, farmers, and businesses manage expenses more efficiently. The reforms are also aligned with the government’s vision of Aatmanirbhar Bharat, ensuring that affordability, consumption, and economic participation are accessible to all.

This is not just a revision of tax rates — it’s a structured effort to improve the quality of life, empower citizens, and support businesses through increased demand and better financial inclusion. Below are 6 powerful ways this reform is making an impact.

1. Daily Essentials – Relief for Every Household

Tax cuts on everyday products like hair oil, shampoo, toothpaste, soaps, snacks, and baby care items are helping families reduce monthly expenses. Lower GST rates on essential goods enhance affordability, especially for middle- and lower-income households, improving their purchasing power and quality of life.

2. Farmers and Agriculture – Empowering Rural Economies

Agricultural inputs such as tractors, fertilizers, micro-nutrients, pesticides, and irrigation equipment are now available at lower tax rates. These changes help reduce operational costs for farmers, boost productivity, and promote sustainable agricultural practices, which in turn strengthen rural livelihoods and the overall economy.

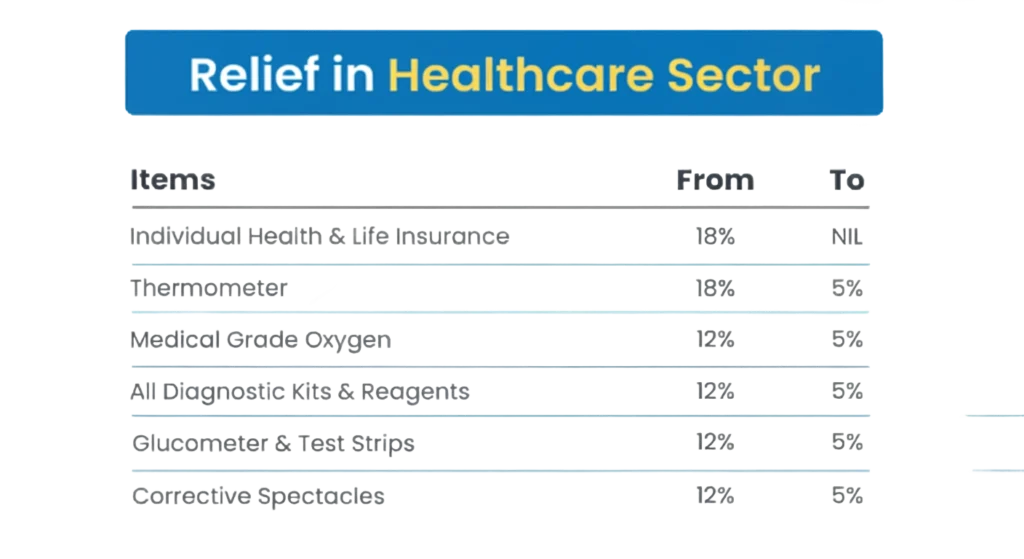

3. Healthcare Sector – Accessible Care for All

Critical healthcare products like medical oxygen, diagnostic kits, test strips, spectacles, and health insurance are now taxed at much lower rates or exempted altogether. These reforms ensure that essential healthcare services and products are accessible to all segments of society, improving health outcomes and reducing medical expenses.

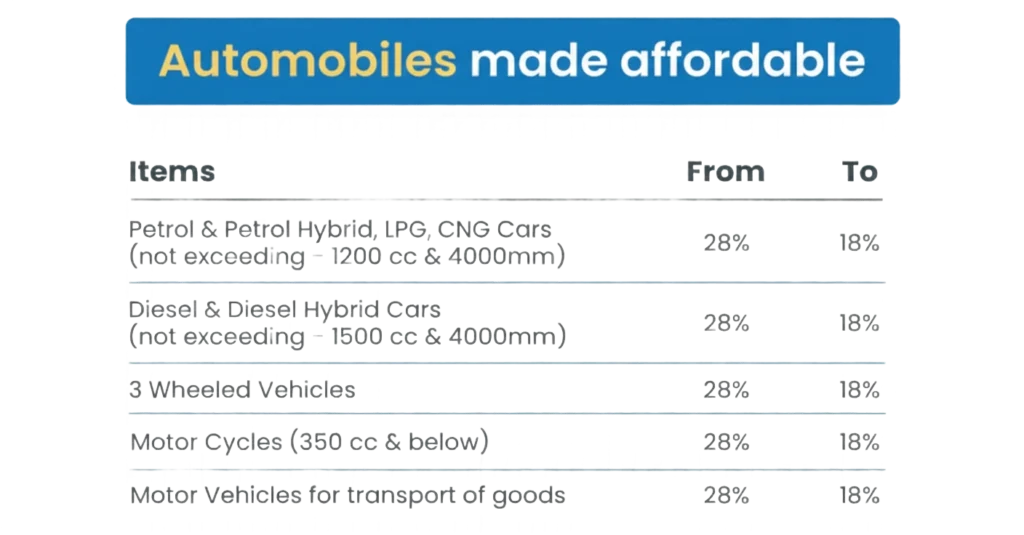

4. Automobiles – Affordable Mobility for Consumers

The new GST structure has lowered taxes on vehicles such as small cars, motorcycles, and transport vehicles. This makes mobility solutions more affordable, supporting personal travel and goods transportation. Reduced costs in this sector can boost vehicle ownership and logistics operations across urban and rural regions.

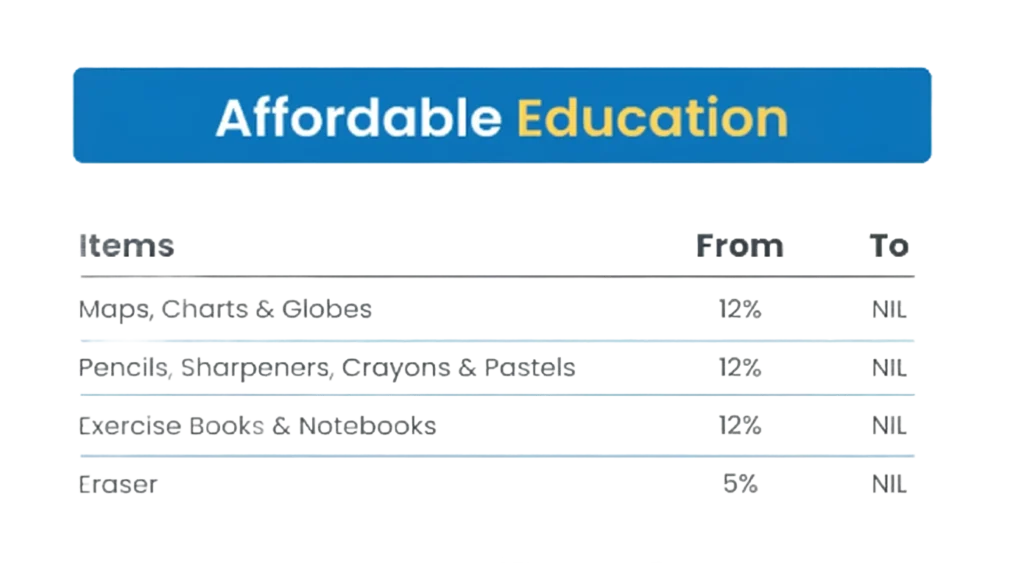

5. Education – Learning Made Affordable

Stationery and learning tools like exercise books, charts, maps, globes, pencils, and erasers are now tax-free or subject to lower rates. This reform reduces the financial burden on students and parents, supporting access to education and encouraging learning opportunities for children across the country.

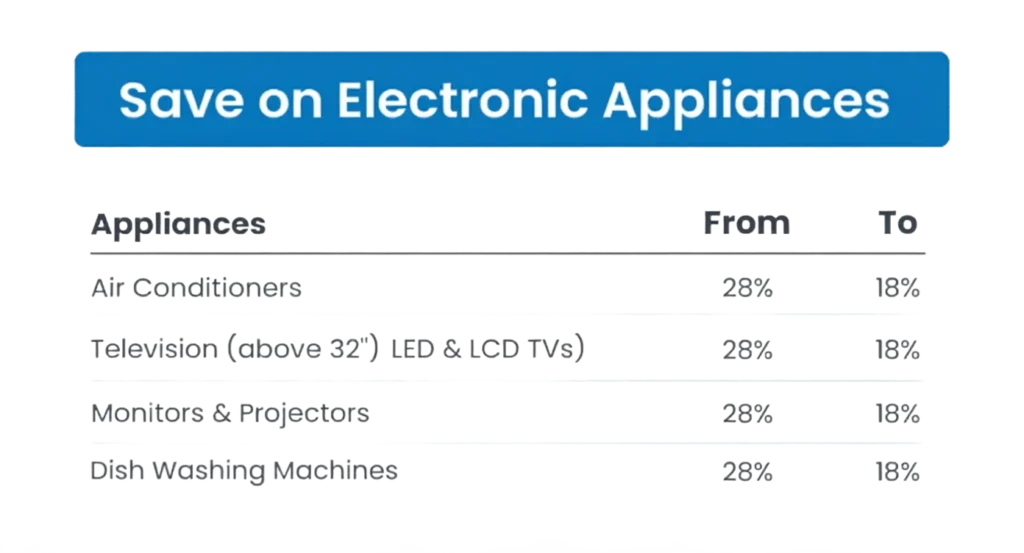

6. Electronic Appliances – Modern Living Within Reach

Products like air conditioners, televisions, monitors, and dishwashers have seen their tax rates reduced from 28% to 18%. This makes technology more accessible, enabling households to upgrade essential appliances without stretching their budgets, thereby improving comfort and convenience.

Why This Reform is a Win-Win

- Encourages Spending: Lower taxes empower families to buy what they need without worrying about high costs.

- Promotes Inclusive Growth: Farmers, students, and middle-income families benefit the most.

- Strengthens Healthcare Systems: Affordable medical products lead to better access and healthier communities.

- Boosts Rural Economies: Agricultural support fosters sustainable development and income growth.

- Enhances Education: Affordable learning materials create better educational opportunities.

- Improves Lifestyle: Access to modern appliances supports convenience and well-being.

A Step Toward Aatmanirbhar Bharat

The GST reform is more than a tax adjustment — it’s a bold move toward building an economy that is resilient, inclusive, and empowering. By focusing on affordability and accessibility, this reform aims to ensure that every citizen, from farmers in rural areas to students in cities, can participate in the nation’s progress.

With improved consumption patterns, better healthcare access, and reduced operational costs, the GST changes are helping create a healthier, wealthier, and more empowered society.

For More Information

For details on GST notifications, rates, and official updates, visit the Government of India’s GST portal here: https://www.gst.gov.in

This portal provides accurate, up-to-date information and guidelines for businesses and consumers alike.

Disclaimer: This article is based on information available from public sources. It has not been reported by EQMint journalists. EQMint has compiled and presented the content for informational purposes only and does not guarantee its accuracy or completeness. Readers are advised to verify details independently before relying on them.

Navratri Sales Boom 2025: India’s Festive Spirit Ignites Record-Breaking Growth As GST Cuts Fuel Consumption Surge | EQMint

[…] and state governments played a key role in boosting consumer sentiment. The government’s move to lower GST rates on several goods and services not only eased the burden on households but also encouraged discretionary spending during the […]