The U.S. government’s decision to impose a $100,000 fee on new H-1B visa applications has sent shockwaves through the Indian IT sector. Announced in September 2025, the new policy is set to apply to all new H-1B visa petitions starting from the 2026 lottery cycle. Investors reacted sharply, sending key IT stocks and the Nifty IT index into a downward spiral. The sudden policy shift highlights how sensitive the Indian IT sector is to U.S. immigration policies, particularly given its heavy reliance on sending skilled professionals to the United States under the H-1B visa program.

Immediate Stock Market Reaction

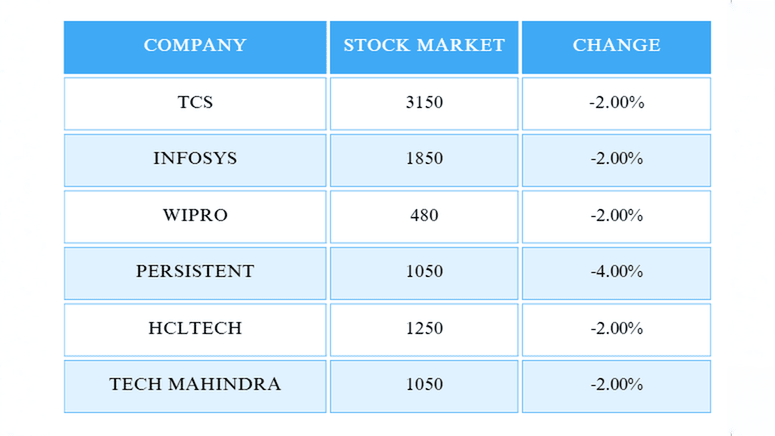

On the day the announcement was made, Indian IT stocks experienced a significant drop. The Nifty IT index fell approximately 2.6%, with major firms like Tata Consultancy Services (TCS), Infosys, and Wipro seeing declines of around 2%. Persistent Systems posted the steepest fall at 4%, while HCL Technologies and Tech Mahindra also recorded losses of approximately 2%.

The sudden market reaction underscored the perceived financial burden the new fee would impose on Indian IT companies. Many of these firms derive a large portion of their revenue from U.S.-based projects, and H-1B visa holders play a crucial role in delivering these services. Investors immediately factored in the potential increase in operational costs, which could reduce profit margins and impact future earnings.

Why Investors Panicked

The Indian IT sector is highly sensitive to U.S. immigration regulations because a significant percentage of its workforce is deployed in the United States under an H-1B visa. These employees typically handle client-facing roles, project management, and technical delivery. The $100,000 fee represents a substantial financial burden for companies that sponsor multiple visas annually.

Investors were concerned not only about the immediate financial impact but also about the long-term implications. Higher costs could force companies to reconsider expansion plans, delay hiring, or increase prices for U.S. clients, potentially affecting competitiveness. Additionally, the sudden nature of the announcement created uncertainty, which is usually reflected in market volatility.

Clarification and Market Stabilization

After the initial market shock, the White House clarified that the new fee would apply only to new visa applications starting in 2026 and would not affect existing H-1B visa holders or renewals. This reassurance provided partial relief to investors and helped stabilize stock prices to some extent.

Despite the clarification, the high fee still represents a potential operational challenge for IT companies. Firms are now evaluating strategies to adapt, such as increasing local hiring in the U.S., expanding remote delivery models, and investing in upskilling American talent to reduce dependence on H-1B visas. While these measures are long-term solutions, they do require significant investment and careful planning, which continues to weigh on investor sentiment.

Long-Term Market Implications

Analysts suggest that the H-1B visa fee hike could lead to structural changes in the Indian IT sector’s U.S. operations. Companies may reduce the number of employees sent to the U.S., increasing reliance on remote work from India. While this approach mitigates visa-related costs, it may affect client relationships and operational flexibility, which are key revenue drivers for IT firms.

The fee hike also increases uncertainty for investors. Historically, regulatory changes in immigration policy have directly impacted stock performance, especially for companies heavily reliant on international deployment. This event is expected to lead to continued volatility in the near term, as companies adjust strategies and investors reassess valuations based on the new cost structures.

Sectoral Ripple Effects

The impact of the fee is not confined to IT stocks alone. It could influence broader market indices due to the weight of IT stocks in the Nifty and Sensex. Additionally, other sectors that depend on skilled H-1B professionals, including healthcare and engineering services, may experience indirect pressure on their stock valuations.

Furthermore, investor sentiment toward mid- and small-cap IT firms is likely to remain cautious. These companies have fewer resources to absorb additional costs and may experience sharper stock price fluctuations compared to industry giants like TCS and Infosys.

Impact of $100,000 H-1B Visa Fee on Key Indian IT Stocks

Conclusion

The $100,000 H-1B visa fee hike has demonstrated how immigration policies can have immediate and far-reaching effects on stock markets. Indian IT companies, which rely heavily on U.S.-based workforces, faced an immediate sell-off, highlighting investors’ sensitivity to regulatory risk. Although subsequent clarifications provided some relief, long-term implications on hiring practices, operational costs, and profitability are expected to influence market performance in the months ahead.

For investors and market watchers, the episode underscores the importance of closely monitoring geopolitical and regulatory developments that directly impact sectors with international exposure. Indian IT firms are now under pressure to adapt strategically to maintain market confidence while navigating a new era of higher visa costs and regulatory scrutiny.

Disclaimer: This article is based on information available from public sources. It has not been reported by EQMint journalists. EQMint has compiled and presented the content for informational purposes only and does not guarantee its accuracy or completeness. Readers are advised to verify details independently before relying on them..