Author: Aditya Pareek | EQMint | General News

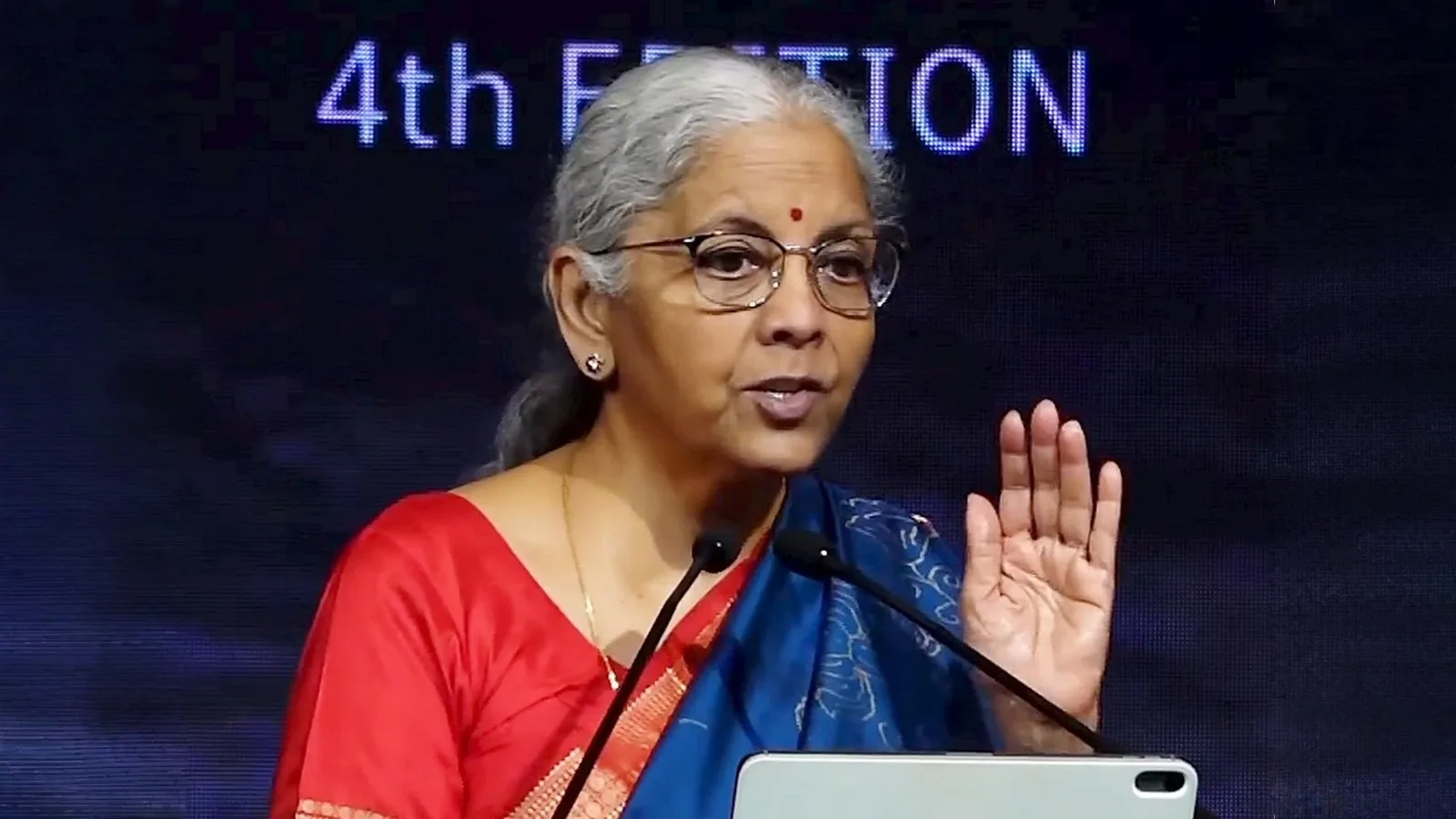

In a landmark move aimed at strengthening India’s position as a global financial hub, Finance Minister Nirmala Sitharaman on Monday launched the country’s first foreign currency settlement platform at the GIFT City (Gujarat International Finance Tec-City) in Gandhinagar. The platform is expected to revolutionize how international transactions are conducted by providing a mechanism for settling cross-border trades directly in foreign currencies — a step that could significantly reduce India’s dependence on external clearing systems.

The new system will enable banks and financial institutions operating from GIFT International Financial Services Centre (IFSC) to settle global trade transactions in foreign currencies such as the US dollar, British pound, euro, and yen. Officials described it as a transformative step toward making India a preferred global financial destination.

Strengthening India’s Financial Independence

Speaking at the launch, the Finance Minister emphasized that the new platform aligns with India’s long-term vision of building self-reliant and globally competitive financial infrastructure. “With this launch, we are not only reducing our reliance on international settlement systems but also moving closer to the vision of India becoming a major player in global finance,” she said.

This initiative will allow banks within GIFT City to clear and settle cross-border payments domestically instead of routing them through international hubs like London, New York, or Singapore. As a result, it is expected to lower transaction costs, improve efficiency, and reduce the risk of delays caused by time zone differences or regulatory barriers.

Experts say that the foreign currency settlement platform will also help India hedge against potential geopolitical disruptions in the global payment ecosystem.

What the New Platform Means for Businesses

For Indian exporters, importers, and multinational corporations, the platform offers faster and more secure settlements. Until now, most international transactions were routed through foreign correspondent banks, which often led to high costs and longer processing times.

With this facility, businesses operating from GIFT City will be able to settle their trades within India’s regulatory ecosystem while complying with international standards. It will also make India’s financial institutions more competitive globally, particularly in areas such as trade finance, offshore banking, and foreign exchange operations.

Analysts believe this move could lead to a sharp increase in foreign bank participation in GIFT City. The platform effectively gives global institutions a reason to base their offshore operations in India, providing direct access to a transparent, well-regulated environment.

A Step Forward for GIFT City

The launch further strengthens GIFT City’s role as India’s flagship international financial hub. Over the past few years, the government has aggressively positioned GIFT City as a one-stop destination for global investors, fintech companies, and financial service providers.

The introduction of the foreign currency settlement system now places GIFT City on par with other global financial centers such as Dubai, Hong Kong, and Singapore. It complements earlier reforms, including the establishment of the International Financial Services Centres Authority (IFSCA), which regulates and promotes financial services at the hub.

According to senior government officials, several leading global banks have already expressed interest in participating in the new settlement framework. The IFSCA is expected to oversee the operations to ensure compliance, risk management, and transparency in foreign currency transactions.

Reducing Dependence on External Systems

Until now, India has relied on international systems such as SWIFT for most cross-border payment settlements. The launch of the domestic foreign currency platform represents an important stride toward financial sovereignty.

By creating a domestic infrastructure for such settlements, India can better insulate itself from global disruptions and sanctions-related vulnerabilities. The system will also help the Reserve Bank of India (RBI) monitor capital flows more efficiently, improving the nation’s macroeconomic stability.

Financial analysts point out that this reform could eventually pave the way for India to settle a greater proportion of its trade directly in rupees, supporting the government’s broader strategy of de-dollarization and diversification of currency use in international trade.

Part of a Larger Reform Agenda

The launch is part of a broader set of reforms to develop India’s financial architecture. In recent months, the government has introduced measures to encourage foreign direct investment, simplify tax structures for global investors, and promote innovation in the fintech sector.

The Finance Minister noted that India’s financial policy is now designed to serve two goals simultaneously — global competitiveness and domestic resilience. She stressed that the government’s commitment to policy stability, regulatory clarity, and innovation has made India one of the most attractive destinations for global capital.

The foreign currency settlement platform, she said, represents not just a technological achievement but also a symbol of India’s growing capability to shape global financial norms.

Industry Reaction: A Game-Changer

Bankers and market experts hailed the development as a “game-changer” for India’s financial ecosystem. According to them, the platform will give GIFT City a unique advantage in attracting foreign institutions that prefer the security and efficiency of domestic regulation combined with international accessibility.

“This platform is a leap forward in making India self-reliant in cross-border financial services,” said one senior banker. “It brings transparency, speed, and confidence — all the ingredients needed to position GIFT City as a global financial powerhouse.”

The move is also expected to boost India’s ambition of becoming a global hub for sustainable and digital finance, as the system is designed to integrate future technologies like blockchain and AI-driven compliance.

Conclusion

The launch of the foreign currency settlement platform at GIFT City marks a major milestone in India’s journey toward becoming a self-sufficient and globally connected financial powerhouse.

By creating infrastructure that allows global transactions to be settled domestically, India is sending a strong message: it is ready to lead in the new era of transparent, efficient, and inclusive financial systems.

With this step, Nirmala Sitharaman has not only strengthened India’s financial backbone but also reaffirmed the country’s aspiration to stand among the world’s top financial centers.

Disclaimer: This article is based on information available from public sources. It has not been reported by EQMint journalists. EQMint has compiled and presented the content for informational purposes only and does not guarantee its accuracy or completeness. Readers are advised to verify details independently before relying on them.