Author: Aditya Pareek | EQMint | Market News

While headline indices such as the Nifty and Sensex continue to hit record highs, the real picture in the broader market—especially in microcaps—tells a very different story. New data from the universe of 3,697 microcap companies (market cap below ₹1,000 crore) shows that the average investor holding microcap stocks is facing significant drawdowns. Despite strong retail participation and enthusiasm for high-growth emerging companies, performance data suggests that risk in this segment is far higher than most investors assume.

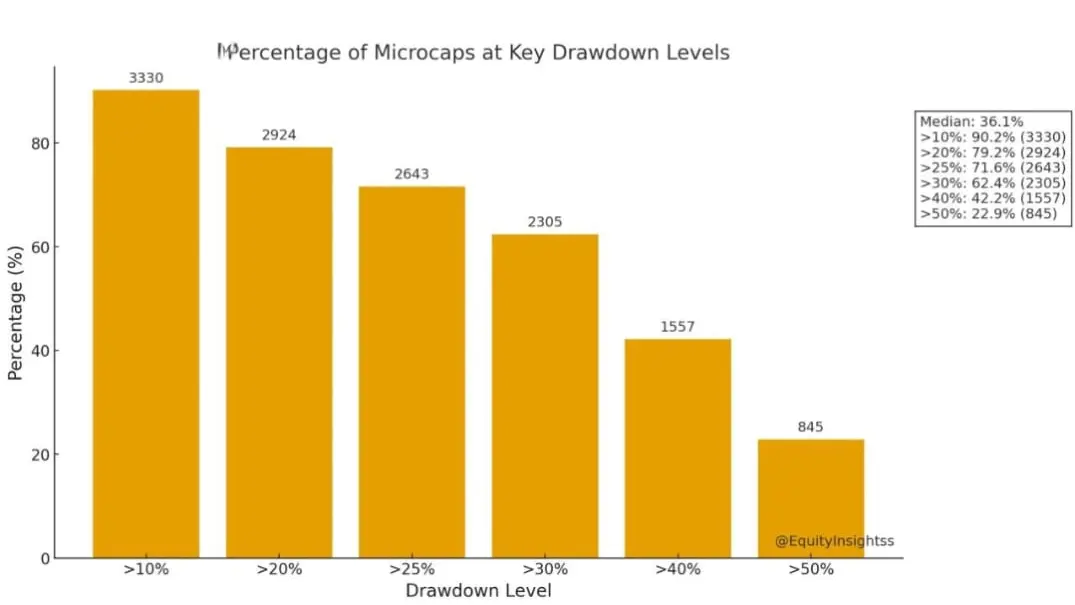

The median drawdown across microcap stocks currently stands at a staggering 36%. That means the typical microcap stock is already one-third below its 52-week high. The depth and breadth of the decline indicate that the weakness in microcaps is not isolated to a few names — it is widespread.

A breakdown of drawdown levels highlights how sharp the correction has been:

- 90% of microcap stocks are down more than 10% from their 52-week highs

- 79% are down more than 20%

- 71% are down more than 25%

- 62% are down more than 30%

- 42% are down more than 40%

- 23% are down more than 50%

In other words, nearly one-fourth of microcap stocks have lost more than half their value from their peak in the past year. The drawdown data underscores that the ongoing correction has been largely invisible at the index level, because mid-cap and small-cap indices mask the extreme selling happening in the microcap corner of the market.

Why are microcaps bleeding?

Several structural and cyclical factors seem to be driving the sharp correction:

1. Excessive valuations driven by liquidity

The microcap space has seen extraordinary inflows from retail investors and small-case–based investing strategies. Many stocks ran far ahead of earnings, pricing in growth years before it could materialize. As liquidity slowed, valuations corrected aggressively.

2. Lower institutional participation

Unlike mid-caps and large-caps, microcaps do not have strong institutional support. During corrections, there are fewer stable buyers, worsening volatility and drawdowns.

3. Profit-booking after a multi-year rally

Microcaps significantly outperformed between 2021 and early 2024. After such a prolonged bull run, even a mild reversal triggered panic selling in stretched names.

4. Poor financial resilience

A large share of microcap companies operate with thin margins, high debt or unpredictable business cycles. In uncertain environments, these weaknesses become amplified.

The behavioural blind spot

One of the biggest risks highlighted by the data is investor psychology. Many retail investors enter microcaps assuming they are “hidden multibaggers.” While some eventually do deliver outsized returns, drawdowns of 40–60% are common along the way. Investors often carry the false belief that diversification among microcaps reduces risk — but in reality, correlations within the segment are high during downturns. When liquidity dries up, almost all microcaps fall together, regardless of fundamentals.

Another trend observed during bull markets is the emergence of narratives that cloud judgement — “low float equals guaranteed upside,” “PE ratio doesn’t matter in growth stories,” “institutional interest will eventually come,” and so on. These narratives work until they don’t, and many investors are currently experiencing this firsthand.

Does this mean microcaps should be avoided?

Not necessarily. Microcaps still represent one of the highest alpha-generating pockets of the stock market — but only for disciplined portfolios and patient investors. Historically, multibagger wealth creation in India has emerged from this segment. However, returns have favoured:

- Investors who buy based on fundamentals, not hype

- Investors who stagger purchases rather than lump-sum entry at highs

- Investors who tolerate prolonged volatility and deep drawdowns

- Investors who exit unsustainable stories early, without anchoring to past prices

The problem arises when microcap investing is treated like a shortcut to fast returns. The present data is a reminder that microcaps are not inherently wealth creators — they are volatility creators first, and wealth creators only for the informed and patient.

What should investors do now?

Market experts recommend caution rather than panic. Investors should:

- Re-evaluate microcap exposure in their portfolio

- Assess whether positions are based on fundamentals or speculation

- Prioritise companies with healthy balance sheets and earnings visibility

- Avoid averaging aggressively in overvalued or deteriorating businesses

- Keep realistic time horizons — microcap turnarounds take years, not weeks

For new investors entering the space, the takeaway is clear: microcaps demand due diligence, risk management and the emotional resilience to withstand deep drawdowns. Without these, investors often exit at the worst possible time — locking in losses while stronger hands accumulate.

Bottom line

The microcap drawdown data paints a stark picture — beneath the surface of a booming market, a large portion of investors are quietly absorbing heavy losses. This phase serves as a timely reminder that investing success is not about chasing fast returns, but about managing risk intelligently. The current cycle doesn’t eliminate microcap opportunities — it simply separates speculation from real investing.

For more such updates visit EQMint.

Disclaimer: This article is based on information available from public sources. It has not been reported by EQMint journalists. EQMint has compiled and presented the content for informational purposes only and does not guarantee its accuracy or completeness. Readers are advised to verify details independently before relying on them.