Author: Rashi Pareek | EQMint | Original article

Mumbai, October 12, 2025 — As India’s retail investment landscape continues to expand rapidly, digital tools are playing a crucial role in empowering investors to make smarter financial decisions. From stock market tracking and portfolio management to technical analysis and cryptocurrency investing, a new generation of investment analysis apps is redefining how Indians invest.

According to data from the Association of Mutual Funds in India (AMFI), retail participation in equity and mutual funds has surged over the past three years, driven largely by the convenience of online platforms and growing financial literacy among young professionals.

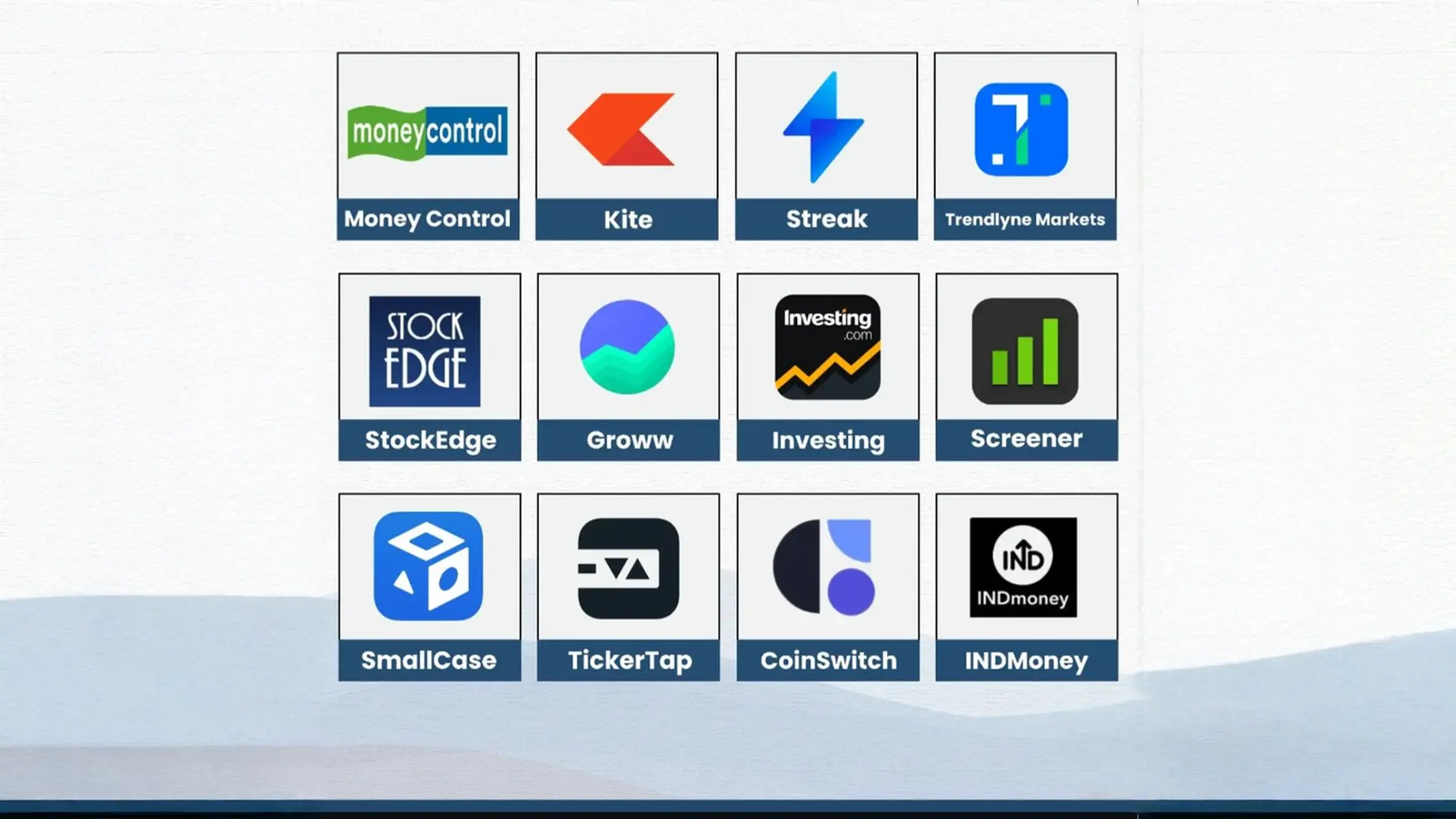

Top 12 investment analysis apps of 2025

1. Moneycontrol

Best for: Market News, Stock Analysis, and Financial Updates

Moneycontrol remains one of India’s most trusted financial platforms. Offering real-time updates on stock markets, mutual funds, commodities, and currencies, it allows users to track indices like Nifty, Sensex, and NASDAQ with precision.

The app provides expert analysis, technical charts, and personalized watchlists, making it ideal for investors seeking comprehensive insights across asset classes.

2. Kite by Zerodha

Best for: Stock Trading and Market Execution

Developed by Zerodha, India’s largest retail stockbroker, Kite is a cutting-edge trading app built for speed and simplicity.

It offers advanced charting tools, technical indicators, and seamless integration with Zerodha’s ecosystem, including Coin for mutual funds and Varsity for investor education. Kite also supports algorithmic strategies via Zerodha Streak, making it popular among tech-savvy traders.

3. Streak

Best for: Algorithmic Trading and Strategy Automation

Streak allows users to create, backtest, and deploy trading strategies without coding knowledge. Integrated directly with Zerodha’s trading platform, it enables traders to automate buy/sell decisions based on real-time market conditions.

With a focus on retail algorithmic trading, Streak helps investors test ideas using historical data, making it one of the most powerful research tools for intraday and swing traders.

4. Trendlyne Markets

Best for: Stock Screener and Market Insights

Trendlyne has gained prominence for its data-driven research and financial analytics. It offers in-depth stock screeners, scorecards, and expert recommendations, covering metrics such as earnings growth, valuation ratios, and momentum indicators.

Trendlyne also integrates broker ratings, mutual fund holdings, and corporate announcements, allowing investors to make more informed stock selections.

5. StockEdge

Best for: Fundamental and Technical Research

StockEdge is a favorite among investors who prefer self-research. The app curates market data, insider trades, bulk deals, and shareholding patterns, helping users identify long-term opportunities.

It also features technical charting tools and investment ideas based on institutional activity, making it suitable for both retail and professional investors.

6. Groww

Best for: Mutual Funds and Direct Stock Investing

Originally focused on mutual funds, Groww has evolved into a full-fledged investment platform offering direct stock investing, fixed deposits, U.S. equities, and ETFs.

Its clean interface and easy onboarding make it beginner-friendly. The app also provides personalized portfolio insights, SIP tracking, and educational blogs — simplifying investing for first-time users.

7. Investing.com

Best for: Global Market Tracking and Economic Data

A global leader in financial information, Investing.com offers real-time data across currencies, bonds, indices, and commodities.

The app provides live charts, economic calendars, and global stock coverage — essential for investors who track both Indian and international markets.

Its customizable watchlists and alerts make it ideal for those managing diversified portfolios.

8. Screener.in

Best for: Fundamental Analysis of Stocks

Screener.in is India’s most popular stock research tool for value investors. It allows users to analyze company financials, track quarterly results, and generate custom filters based on financial ratios like P/E, ROE, and debt-to-equity.

Long-term investors use Screener to identify fundamentally strong companies and build wealth-focused portfolios.

9. Smallcase

Best for: Thematic and Long-Term Investing

Smallcase enables investors to buy curated portfolios of stocks and ETFs based on themes such as green energy, EVs, and dividend income.

Each smallcase is professionally managed and linked to users’ demat accounts, allowing for transparency and easy tracking.

It’s a go-to platform for investors seeking diversified exposure to ideas rather than individual stocks.

10. TickerTape

Best for: Portfolio Analysis and Valuation Insights

TickerTape offers in-depth stock screeners, valuation models, and portfolio analysis features.

The platform provides peer comparisons, analyst ratings, and market mood indicators, helping users understand both micro and macro-level market movements.

Its integration with broker platforms allows investors to trade directly from the app.

11. CoinSwitch

Best for: Cryptocurrency Investments

As one of India’s largest crypto investment apps, CoinSwitch allows users to buy, sell, and trade digital assets like Bitcoin, Ethereum, and Solana with ease.

Beyond trading, it also provides real-time price alerts, investment tracking, and portfolio insights, making it a top choice for those exploring digital assets as part of a diversified strategy.

12. INDmoney

Best for: All-in-One Financial Planning

INDmoney is a super app designed for wealth management and goal-based investing. It helps users manage stocks, mutual funds, loans, credit cards, and even U.S. equities in one place.

The app uses AI-driven insights to recommend portfolio rebalancing and tax-saving strategies, appealing to investors seeking holistic financial oversight.

Why These Apps Matter

In an age where investing is increasingly data-driven, these apps provide users with accessibility, transparency, and actionable insights.

Experts say that tools offering real-time analytics, AI-driven recommendations, and user education are set to define the future of personal investing in India.

According to SEBI, over 4.5 crore new demat accounts were opened in FY25, signaling a digital-first investing boom that shows no signs of slowing.

“These apps have democratized investing,” said Amit Jain, Founder of MyFintax. “They make complex financial data simple, allowing even first-time investors to make informed, confident decisions.”

Final Takeaway

Whether you’re a short-term trader looking for technical signals or a long-term investor building wealth systematically, these 12 apps serve as essential companions for research, strategy, and execution.

In 2025, technology and investing are more connected than ever — and the right app can make all the difference.

Disclaimer: This article is based on information available from public sources. It has not been reported by EQMint journalists. EQMint has compiled and presented the content for informational purposes only and does not guarantee its accuracy or completeness. Readers are advised to verify details independently before relying on them.