Author: Dev Patel | EQMint

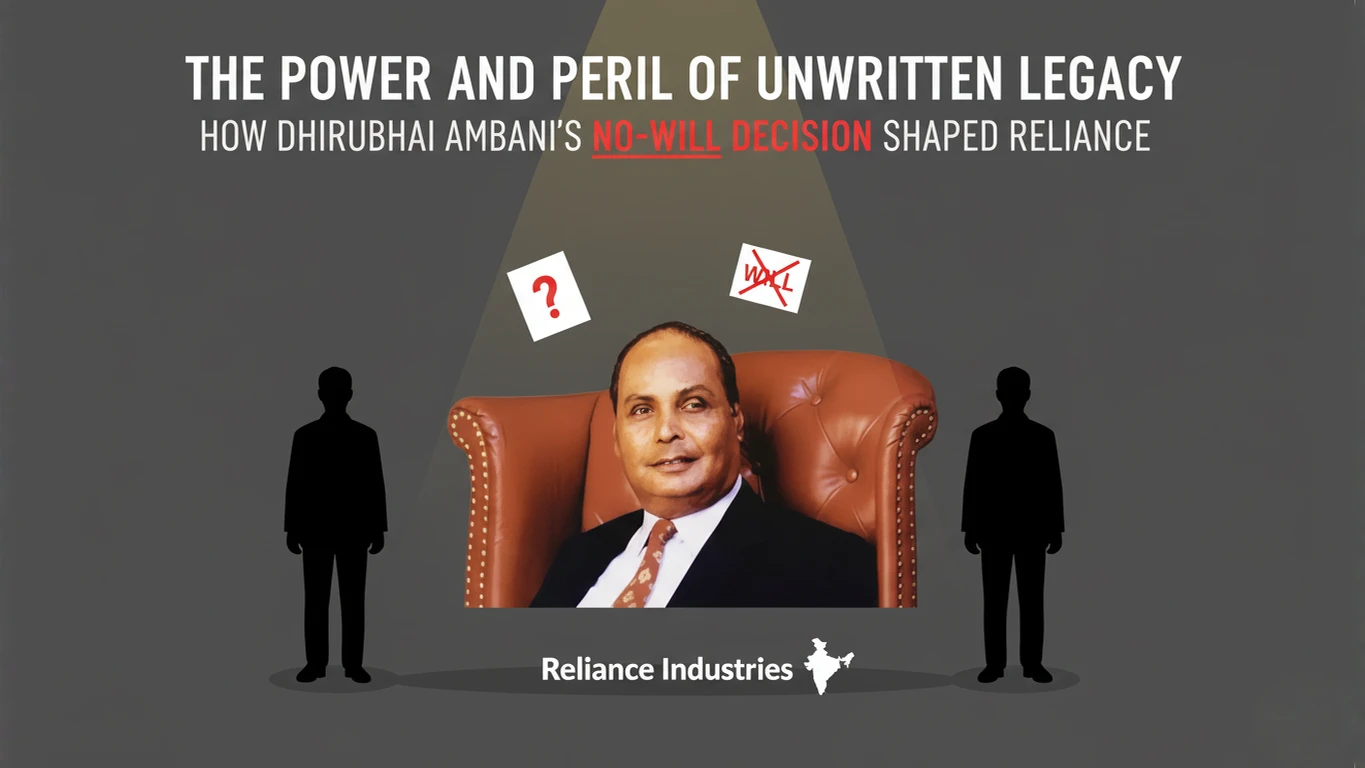

In July 2002, India’s corporate world was shaken by the passing of Dhirubhai Ambani, the visionary who built Reliance Industries from the ground up. Yet, despite his sharp business acumen and ability to foresee opportunities, Dhirubhai Ambani left behind one major gap—he died without a will.

This absence of a formal succession plan not only shocked the business community but also triggered one of the most high-profile family business conflicts in India’s history. It remains a case study in why succession planning is as important as entrepreneurial vision.

The Unwritten Legacy

By the time of his passing, Reliance Industries had become a behemoth spanning petrochemicals, refining, energy, and telecommunications. However, there was no documented succession roadmap to define who would take charge of which division or how ownership would be structured.

Although Dhirubhai Ambani had gradually entrusted responsibilities to his sons, Mukesh and Anil, there was no transparent framework. This ambiguity created uncertainty, leaving the future of one of India’s largest conglomerates hanging in the balance.

The Fallout: Brothers at Odds

The absence of a will quickly became the catalyst for tension between the Ambani brothers. Disagreements about control, leadership, and strategic vision soon emerged in the public eye. Eventually, after intense internal negotiations and family mediation, the empire was split.

-

- Mukesh Ambani assumed control of Reliance Industries Limited, retaining the core businesses in oil refining, petrochemicals, and energy.

-

- Anil Ambani took charge of telecom, financial services, power, and entertainment ventures.

The division offered clarity, but it also highlighted how unresolved succession plans can fracture families, even when vast wealth and influence are at stake.

Lessons for Family Businesses

Dhirubhai Ambani’s case remains a powerful lesson for family-run enterprises everywhere. His story demonstrates that even the most successful entrepreneurs can leave vulnerabilities if they neglect estate planning.

Key lessons include:

-

- Document Everything: Verbal understandings and assumptions are never enough. A formal will, trust structures, or shareholder agreements ensure clarity.

- Plan Early and Update Often: Succession planning should not be left for later stages of life. It must be revisited regularly to reflect changes in business and family dynamics.

- Ensure Transparency: Open conversations with stakeholders help prevent shocks and disputes after the founder’s departure.

- Seek Neutral Advisors: Independent boards or professional advisors can guide transitions and mediate conflicts.

- Build Legacy Beyond Wealth: Passing down values, culture, and governance principles is just as critical as distributing assets.

Why This Story Still Resonates

Two decades later, the Dhirubhai Ambani succession story is still cited in boardrooms, business schools, and family wealth management discussions. It remains a cautionary tale showing how the absence of formal planning can lead to uncertainty, rivalry, and public scrutiny.

It is also a reminder of the deep emotional stakes tied to succession. A family business is not only about assets and profits; it is about relationships, trust, and the founder’s vision. When these are not clearly translated into documented structures, conflicts are almost inevitable.

The Human Side

Behind the headlines was a deeply human story—a father who trusted his children, a family navigating grief, and unspoken expectations that ultimately turned into disputes. Perhaps Dhirubhai Ambani believed his legacy of trust and entrepreneurship would be enough to guide his successors. Instead, the absence of a will left his empire vulnerable to interpretation and conflict.

This is a recurring theme across family businesses. Founders often delay difficult conversations about succession, believing unity will prevail. But as Ambani’s case shows, the lack of formal planning can strain even the strongest bonds.

Final Word

Dhirubhai Ambani’s life story remains one of extraordinary vision, grit, and achievement. From modest beginnings, he built Reliance into a global powerhouse. Yet, his decision to leave without a will added an unexpected chapter—one that revealed the risks of neglecting succession.

His legacy is a reminder that true foresight is not just about building empires but also ensuring their survival beyond one lifetime. Family businesses, regardless of size, must prioritize estate planning as much as innovation and growth.

For today’s entrepreneurs, the Ambani saga offers a clear message: secure your legacy not just through what you create, but through how you prepare for the future.

Disclaimer: This article is based on information available from public sources. It has not been reported by EQMint journalists. EQMint has compiled and presented the content for informational purposes only and does not guarantee its accuracy or completeness. Readers are advised to verify details independently before relying on them.