Mumbai, September 22, 2025: According to a report by Bajaj Broking, the Nifty index has resumed its upward trajectory after a two-month corrective phase, reaffirming investor confidence in India’s equity markets despite global headwinds. BFSL expects the index to retest its all-time high of 26,277 in the coming months and projects a rally toward the 26,800–27,000 zone by March 2026.

The recent correction, far from signaling weakness, has been interpreted as a “healthy retracement” within a broader bullish structure. “Nifty forming a higher high on the monthly chart for the first time in three months is a strong indicator that the structural uptrend remains intact,” said analysts at Bajaj Broking.

Technical Picture: Support and Resistance Levels

The index has key supports at 24,400–24,300, which Bajaj Broking analysts do not expect to be breached in the near term. Short-term support is also visible at 24,800–24,700, aligning with the 20- and 50-day exponential moving averages (EMAs).

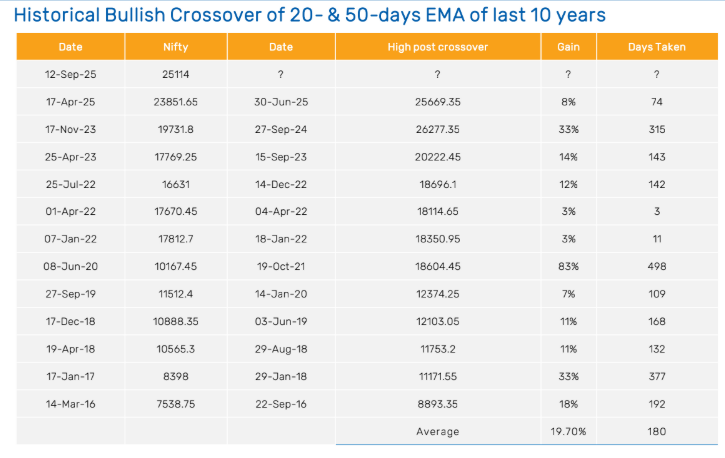

From a trend perspective, Nifty recently witnessed a bullish crossover, where the 20-day EMA moved above the 50-day EMA on September 12, 2025. Historically, such crossovers have been reliable indicators of sustained rallies. An analysis of the past decade by Bajaj Broking shows that post-crossover, the Nifty has delivered an average return of nearly 20%.

“This setup marks the early stage of a potentially strong uptrend. With historical evidence backing it, investors should consider positional long trades,” analysts added

Historical Insights: Lessons from Past Crossovers

In the last 10 years, Nifty has witnessed 12 instances of a 20-day and 50-day EMA bullish crossover. Each event has been followed by positive returns, ranging from a modest 3% to as high as 83% (as seen post the June 2020 crossover). The median return has been 12%, implying a possible upside to ~28,127 from the recent crossover level of 25,114.

This historical trend strengthens the case for the index marching toward the 27,000 mark over the next two quarters, according to Bajaj Broking research.

Sector Outlook: Opportunities Beyond the Index

Thematic strength is also emerging across sectors. Banks, autos, metals, and consumption stocks continue to display relative strength, while bargain opportunities are seen in public sector undertakings (PSUs), telecom, and capital goods. “We believe dips provide buying opportunities in quality large- and mid-cap stocks,” the report by Bajaj Broking said.

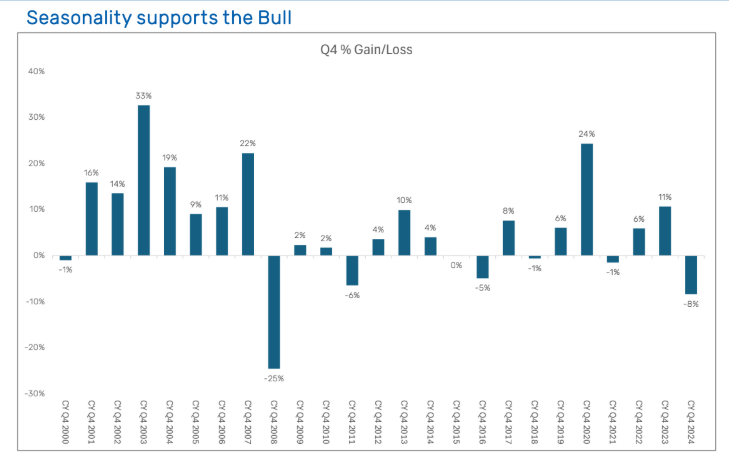

Seasonality and FII Behavior Add to Optimism

Seasonal trends also support the bullish outlook. A study of the past 25 years shows that the last quarter of the calendar year has been positive 72% of the time, with an average gain of 4%. This seasonal bias, combined with improving foreign institutional investor (FII) positioning, adds weight to the bullish case.

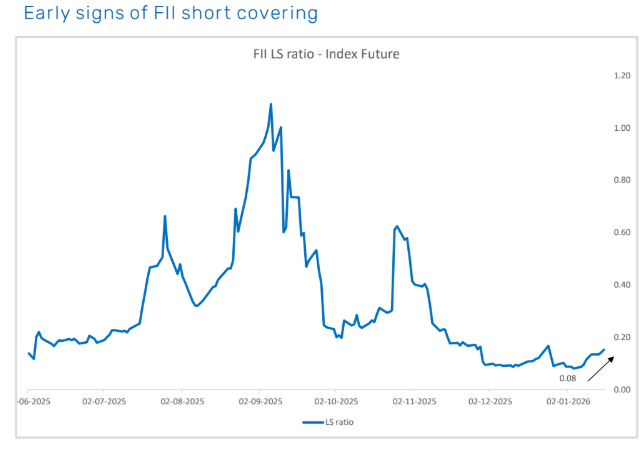

On September 5, 2025, FIIs’ long-short (L/S) ratio in index futures hit a historic low of 0.08, reflecting heavy bearish positioning. Since then, FIIs have covered nearly 32,340 short contracts while adding fresh longs, pushing the ratio up to 0.15. Although still below the 0.30 threshold for a confirmed short-covering rally, analysts view this as an early sign of a sentiment shift.

Historically, once the L/S ratio crosses 0.30, Nifty has delivered an average of 8.2% positive returns in the subsequent three months.

Derivatives and Options Data Reinforce Bullish Bias

Options activity further supports the view of higher levels ahead. Significant put writing has been observed at 26,000 and 26,500 strikes in the October series, indicating strong confidence among market participants that Nifty will sustain above these levels.

To capitalize on the bullish outlook, Bajaj Broking recommends a bull call spread strategy in Nifty’s October series:

-

- Buy 25,600 CE (28th Oct) at ₹262.35

-

- Sell 26,200 CE (28th Oct) at ₹73.15

This strategy offers a maximum profit potential of ₹30,810 against a maximum risk of ₹14,190, with a favorable risk-reward ratio of 1:2.

Resilient Markets Amid Global Headwinds

Despite escalating geopolitical tensions and tariff-related developments worldwide, Indian equity markets have shown remarkable resilience. The report attributes this strength to robust domestic investor participation and structural support in key sectors.

Looking ahead, analysts remain optimistic. “We expect Nifty to gradually head toward the 26,800–27,000 range over the next two quarters. The overall market structure continues to favor a buy-on-dips approach,” the report concluded.

For more in-depth analysis and detailed insights by Bajaj Broking, click here.

Disclaimer: This article is based on information available from public sources. It has not been reported by EQMint journalists. EQMint has compiled and presented the content for informational purposes only and does not guarantee its accuracy or completeness. Readers are advised to verify details independently before relying on them.